As 2023 begins, Arval Mobility Observatory is pleased to share with you a synthesis of changes to statutory taxation and the associated mechanisms evolutions in Europe, by country. As follows, you will find a non-exhaustive list highlighting the evolution of Governmental taxation, grants and bonus schemes for 2023 in some European countries (such as Belgium, France, Germany, Italy, Greece, Luxemburg, the Netherlands, Norway, Portugal, Spain, Sweden, Slovakia) Switzerland and the United Kingdom.

Belgium

Social contribution (CO2 tax)

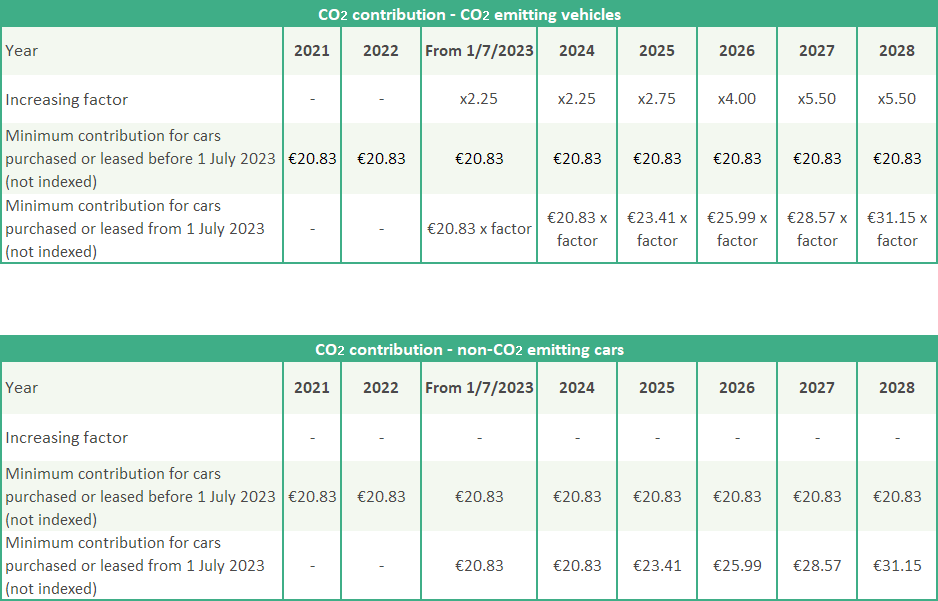

From the 1st of July 2023 onwards, the Belgian Government will gradually increase the social contribution that the buyer has to pay for cars emitting CO2.

In addition, the minimum contribution will also be increased in phases from 2025 onwards, reaching a minimum monthly contribution of € 31.15 (not indexed) in 2028. The current scheme will continue to be effective, but the result obtained under that scheme will be systematically multiplied for CO2 emitting vehicles by an increasing factor:

- Until the 31st of December 2024, this factor is 2.25.

- In 2025, the factor will increase to 2.75.

- In 2026, the factor is to be increased to 4.

- As of 2027, the factor will peak at 5.50.

Fiscal deduction of car costs

Plug-in hybrid electric cars purchased or leased from the 1st of January 2023 will see the fiscal deduction of petrol or diesel costs limited to a maximum of 50%.

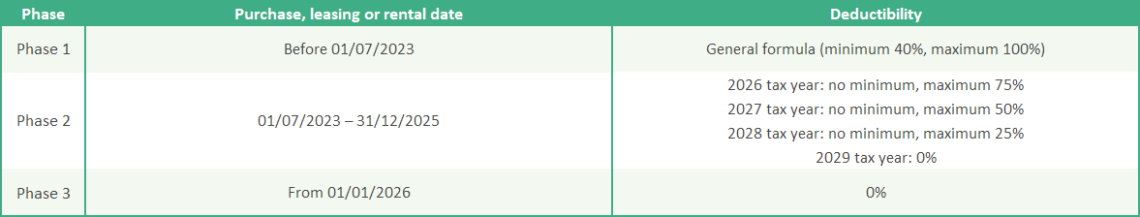

Cars emitting CO2 emissions (including PHEVs) purchased/leased from the 1st of July 2023, will enter into a transitional taxation scheme. During this transitional period, the current scheme will continue to apply, but the deductibility caps will be systematically lowered from income year 2025 (tax year 2026) onwards, while the minimum deductibility percentage will no longer apply.

Additionally, the tax deductibility will be capped at 75% for tax year 2026, 50% for tax year 2027 and 25% for tax year 2028, finally leading to a full deduction ban for tax year 2029.

Vehicles for which no CO2 emission data is available will not be eligible for a deduction.

BIK taxation 2023

For the 2023 income year (2024 tax year), the benefit in kind amounts to at least €1,540 per year, before deduction of any personal contribution.

To see the evolution of taxation in 2023 in France, Germany, Italy, Greece, Luxemburg, the Netherlands, Norway, Portugal, Spain, Sweden, Slovakia, Switzerland and in the United Kingdom, click here (article only available in English).

Do you want to read more Arval Mobility Observatory news?

You find the Arval Mobility Observatory newsroom here.